Digital Account Application

Designed by Alphie Chen

Type: UX/UI Design

Type: UX/UI Design

Founded in 1985, First Republic Bank was a commercial

bank and provider of wealth management services

headquartered in San Francisco.

“It's a privilege to serve you” is the apropos tagline for

First Republic Bank, as they're known for exceeding

expectations and serving clients in unexpected ways.

The previous First Republic’s digital account application

flow had several problems that resulted in a high drop-off

rate. As a result, the entire flow needed to be redesigned

to address these problems, making it more user-friendly

and easier for clients to open an account online, ultimately

reducing the drop-off rate.

As a product designer at First Republic, my role was

to redesign the digital account application. This page

highlights three major redesigns I worked on:

the progress indicator, account type selection, and

address validation.

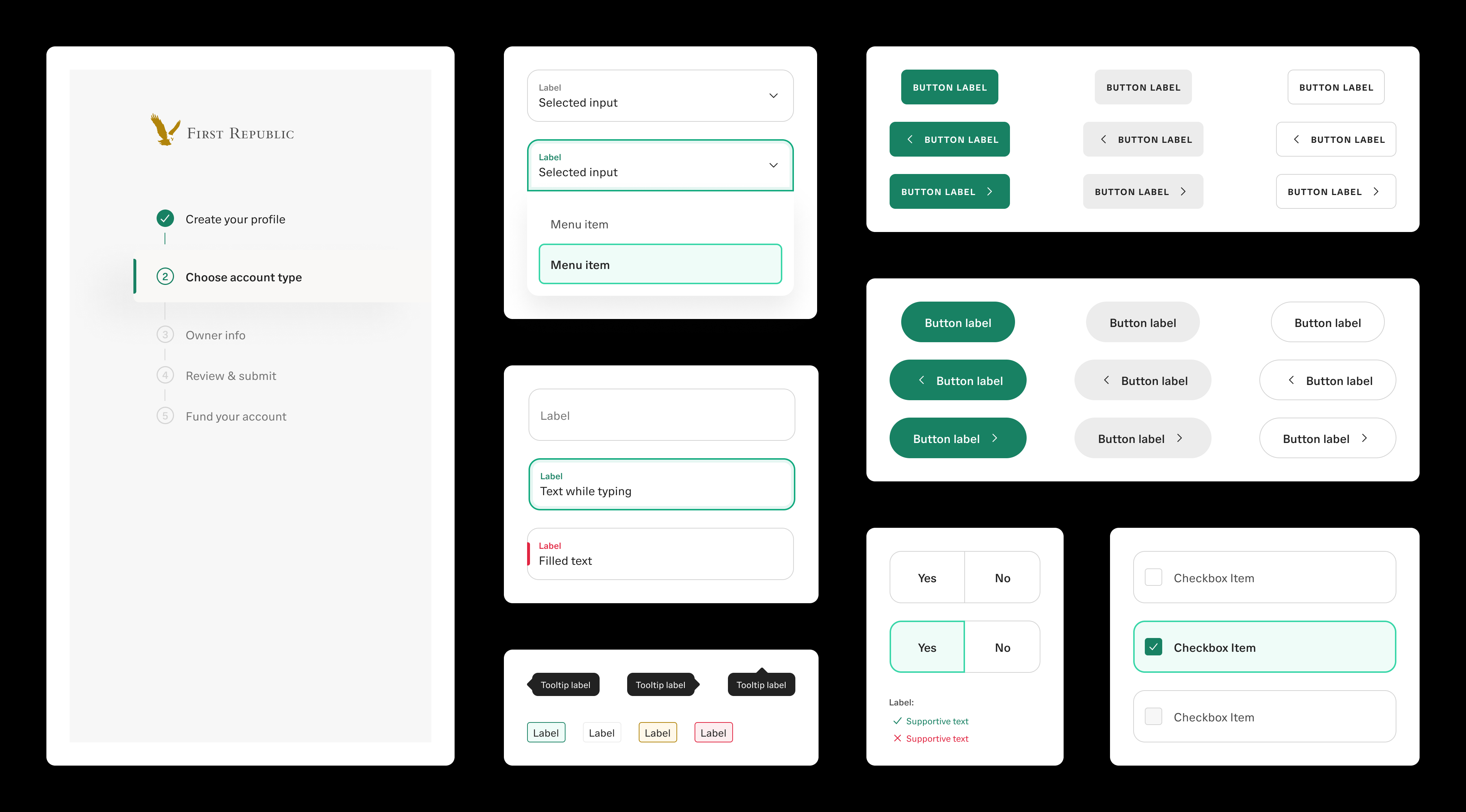

Additionally, it showcases the reusable components

we added to the design system for consistency across

other banking products.

bank and provider of wealth management services

headquartered in San Francisco.

“It's a privilege to serve you” is the apropos tagline for

First Republic Bank, as they're known for exceeding

expectations and serving clients in unexpected ways.

Project Overview

The previous First Republic’s digital account application

flow had several problems that resulted in a high drop-off

rate. As a result, the entire flow needed to be redesigned

to address these problems, making it more user-friendly

and easier for clients to open an account online, ultimately

reducing the drop-off rate.

My Role

As a product designer at First Republic, my role was

to redesign the digital account application. This page

highlights three major redesigns I worked on:

the progress indicator, account type selection, and

address validation.

Additionally, it showcases the reusable components

we added to the design system for consistency across

other banking products.

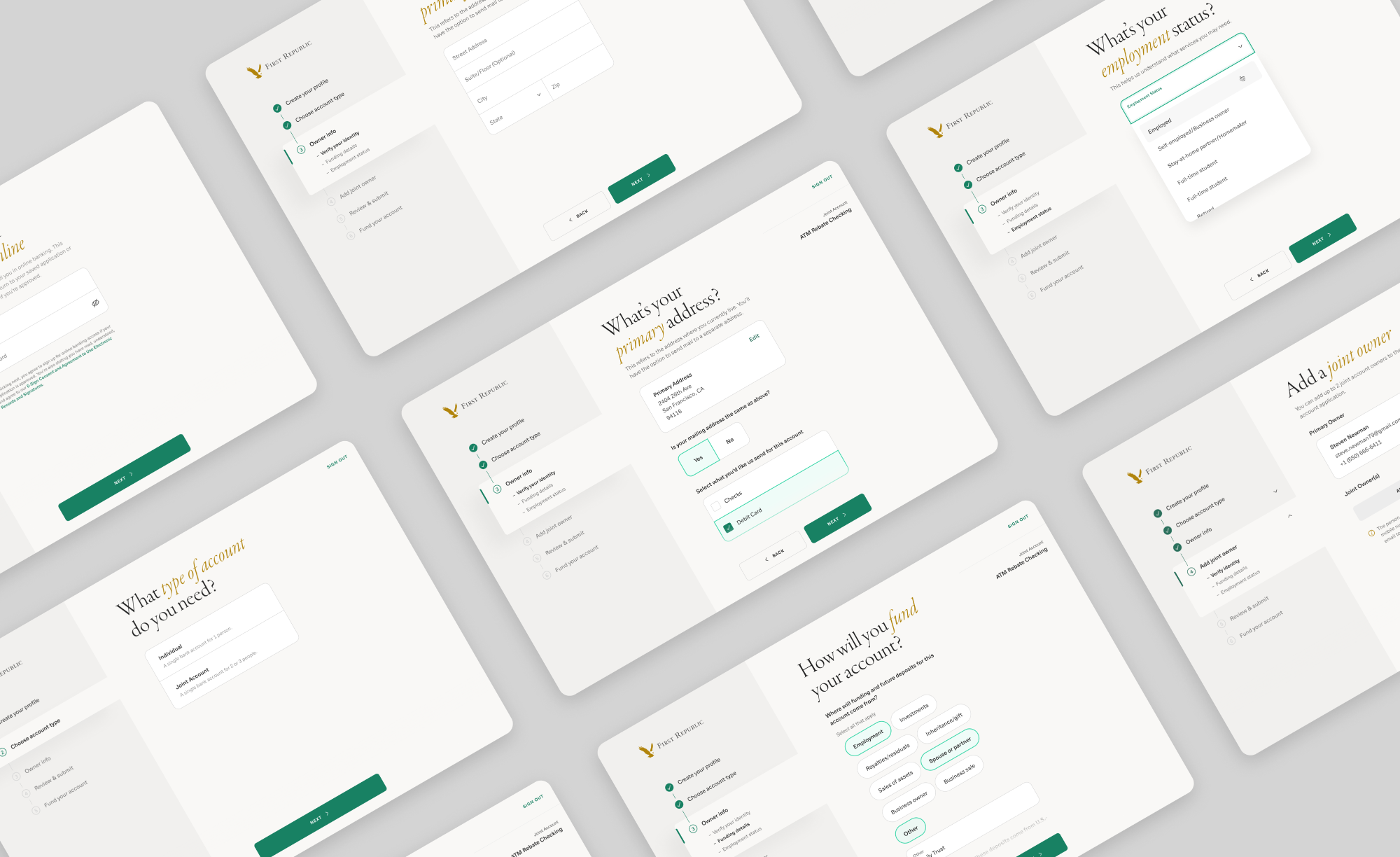

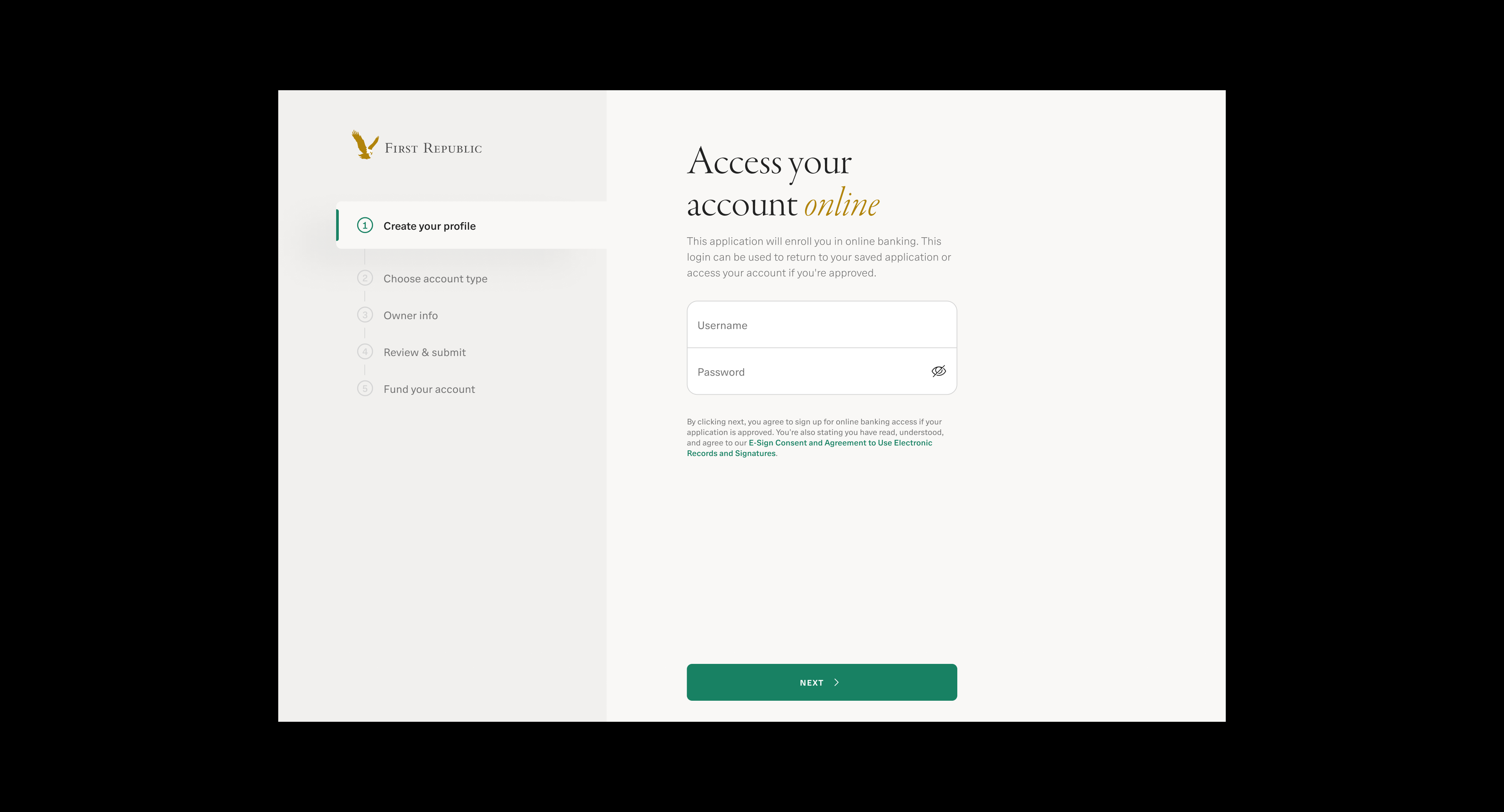

Progress Indicator

Before

After

Problem

Problem

The previous digital account application flow has a high

abandon rate because most of the pages are long

scrolling pages and don’t have a progress bar to show

applicants what step they’re on. Therefore, lots of

applicants often drop the application because they get

impatient and think there are still tons of steps to

be completed.

Goal

Reduce the drop-off rate of digital account application.

Solution

Introduce a progress bar and break down the flow into

six steps: Create your profile, Choose account type,

Owner info, Review & submit, and Fund your account.

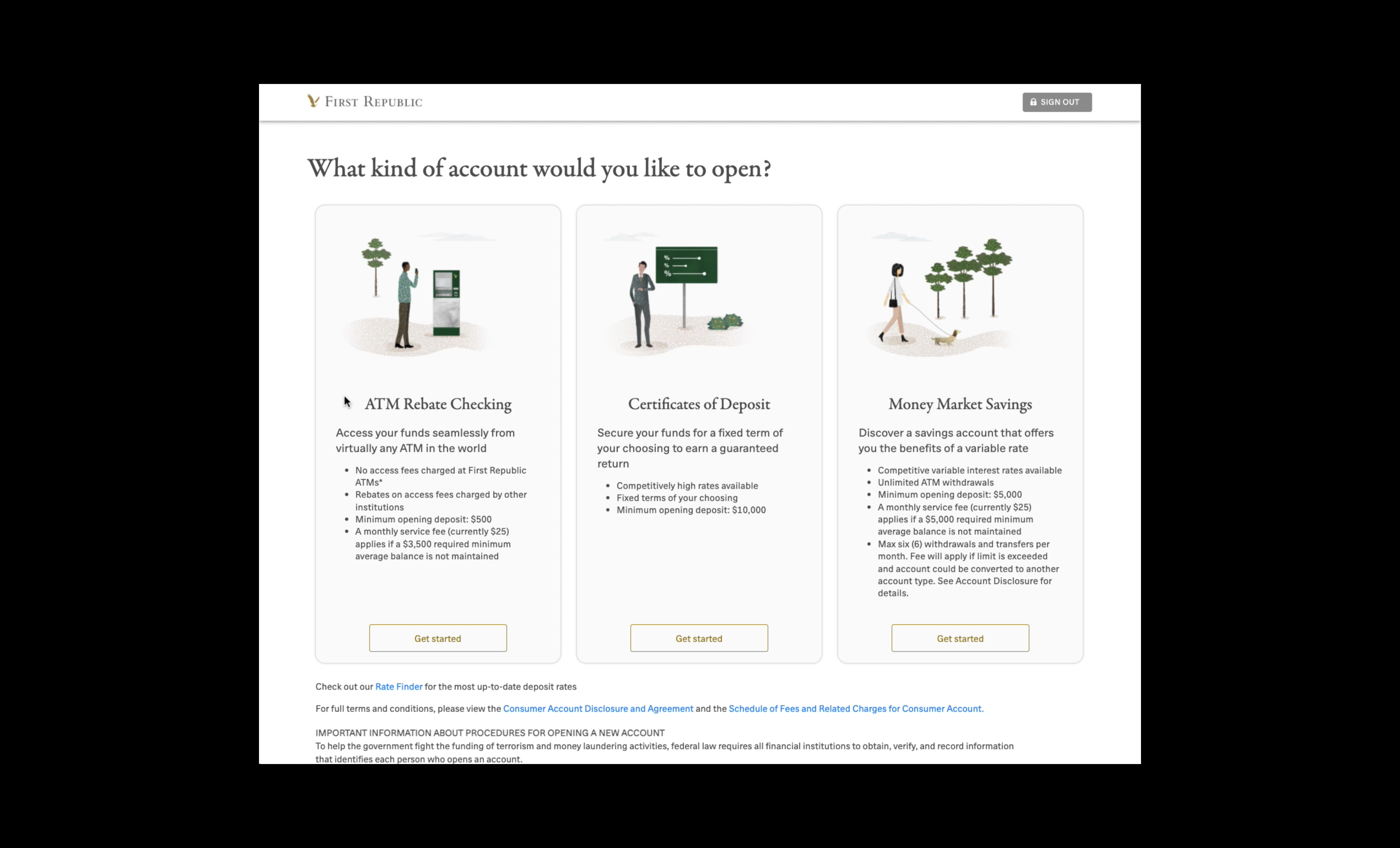

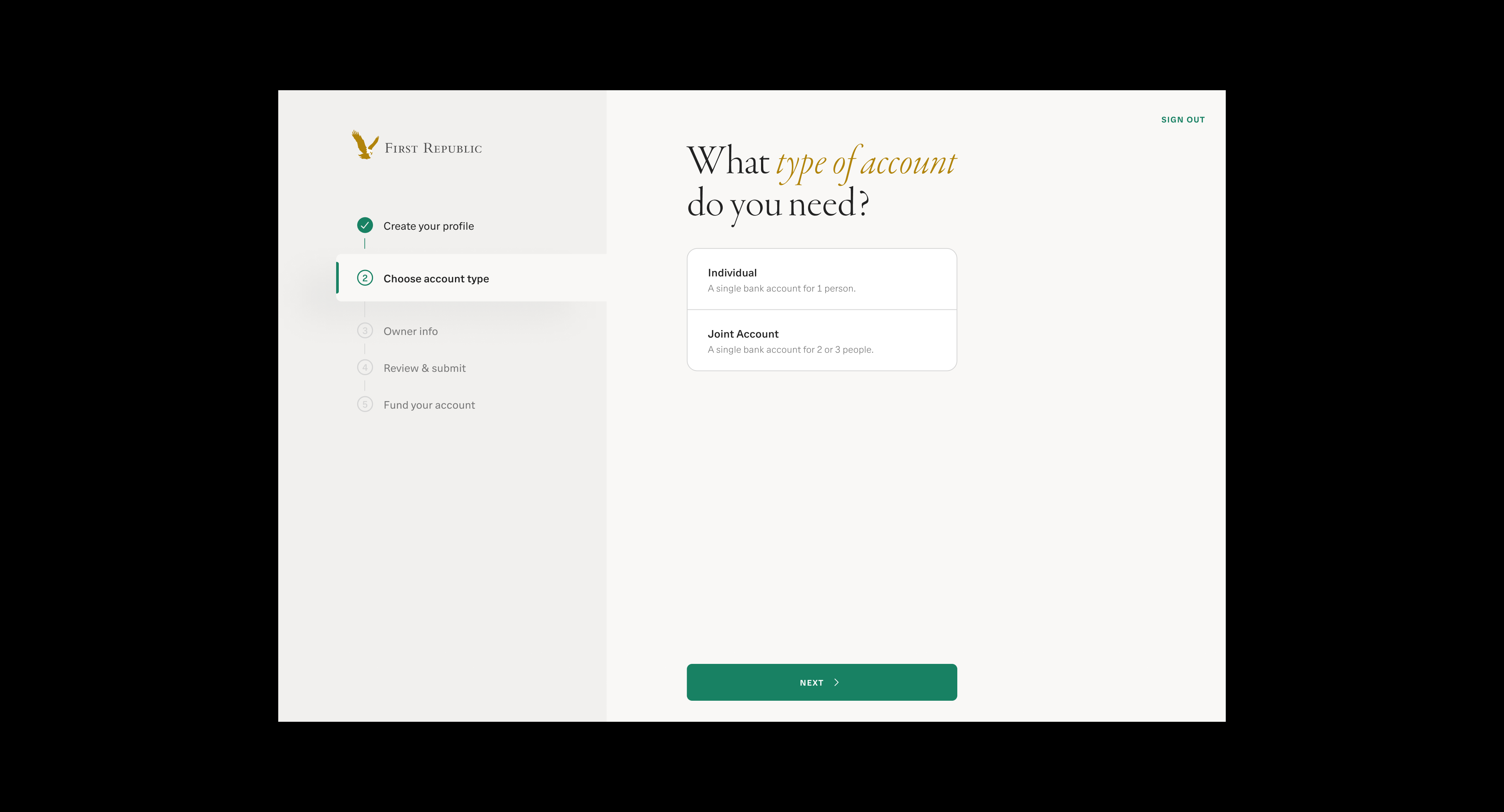

Choose Account Type

Before

After

Problem

Problem

The previous product selection page only displays three

types of individual accounts—checking, savings, and

CDs—and doesn’t indicate that First Republic also offers

these as joint accounts.

Goal

Clearly indicate that First Republic offers checking,

savings, and CDs for both individual and joint accounts.

Solution

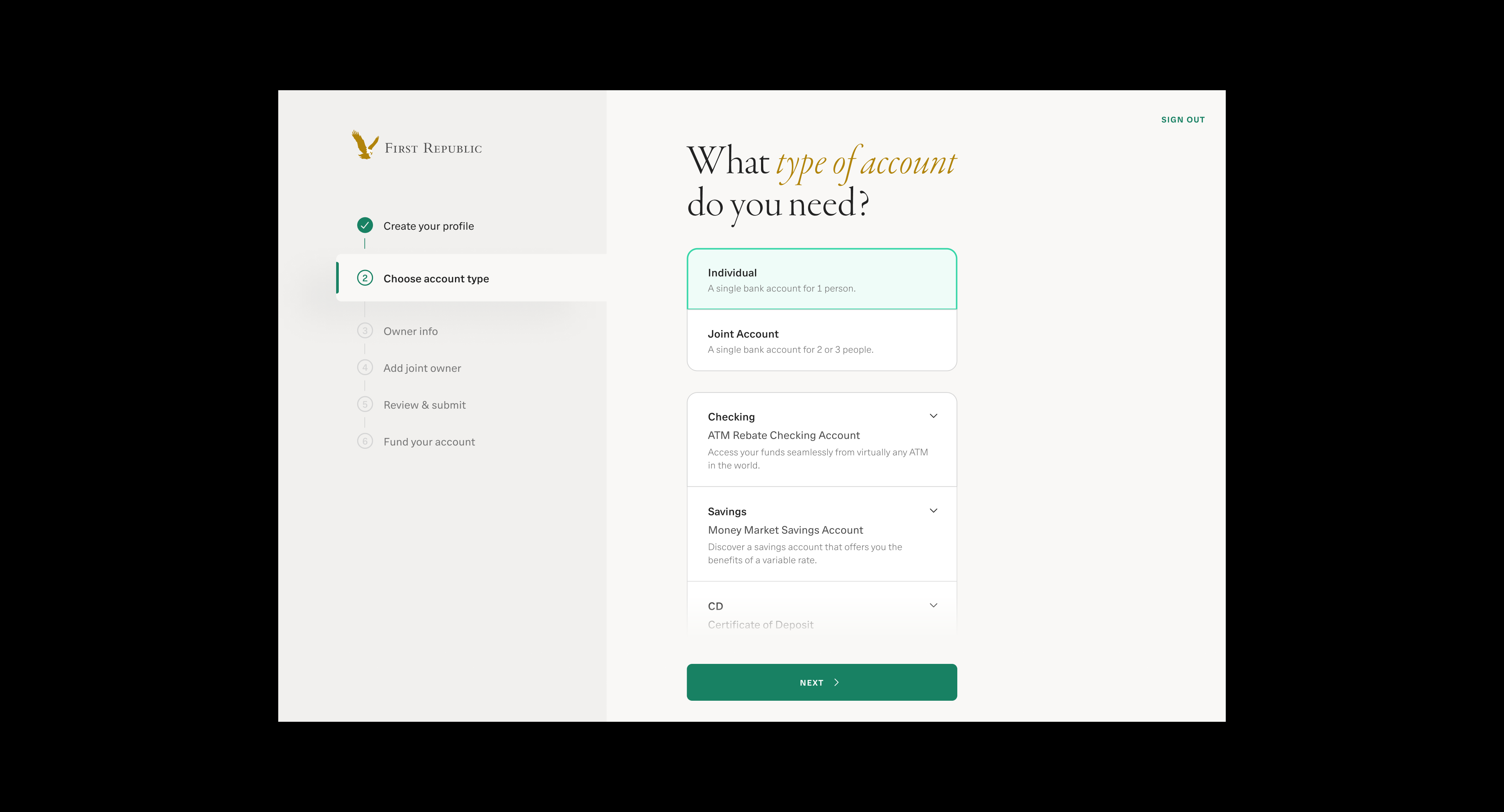

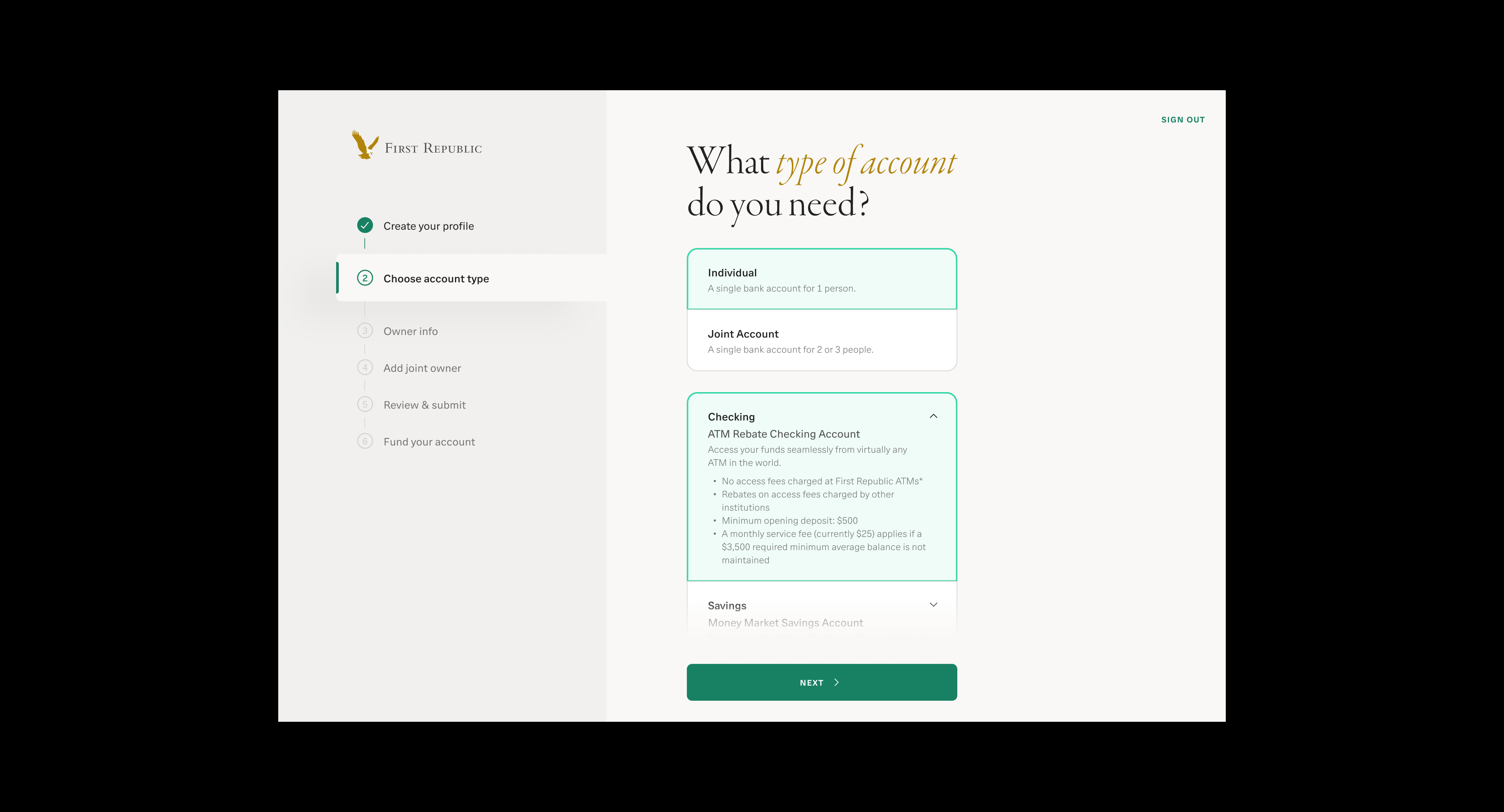

In the redesign, applicants first choose whether they

want to open an individual or joint account, and then

select the type of account they’re interested in.

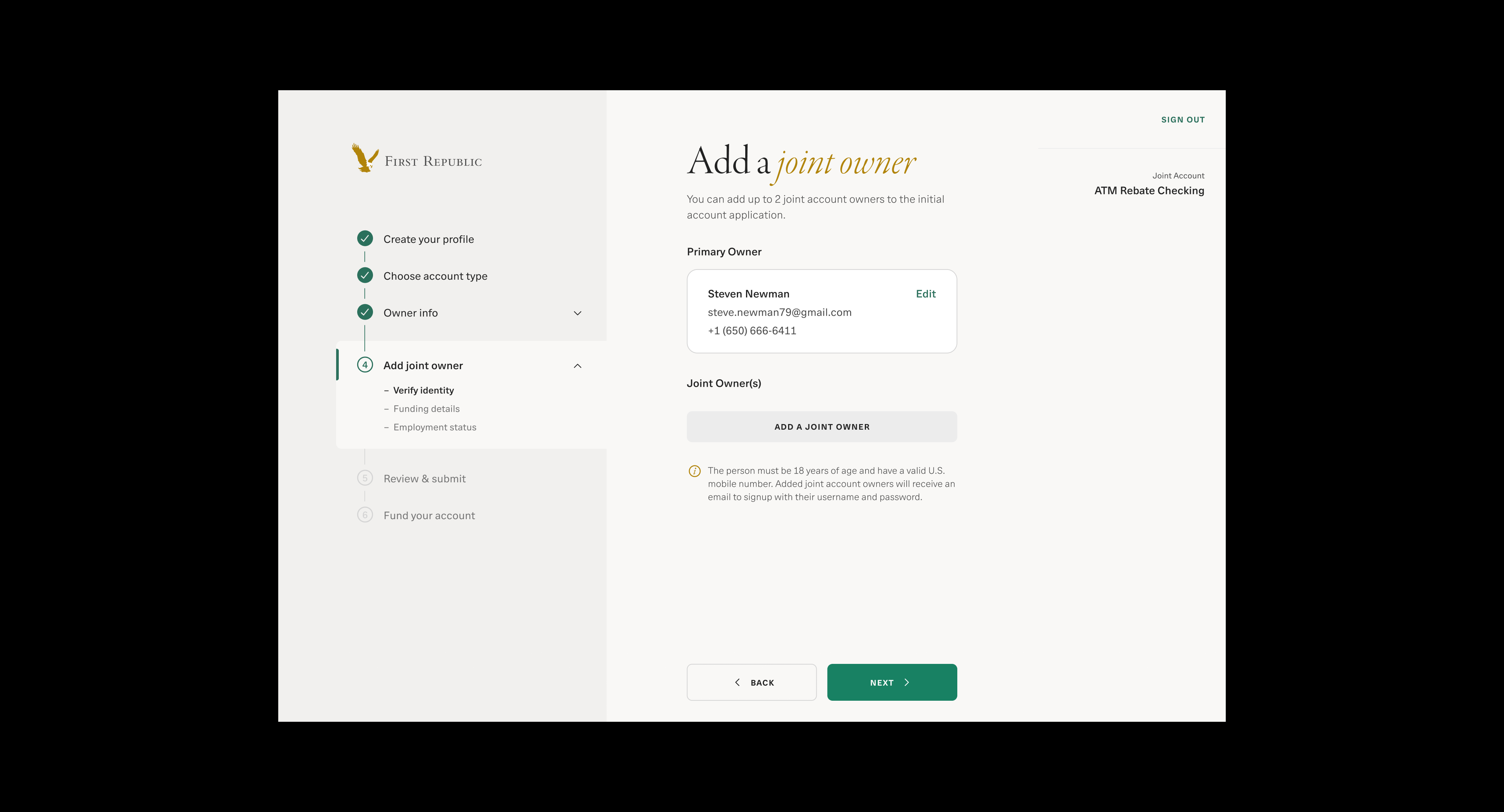

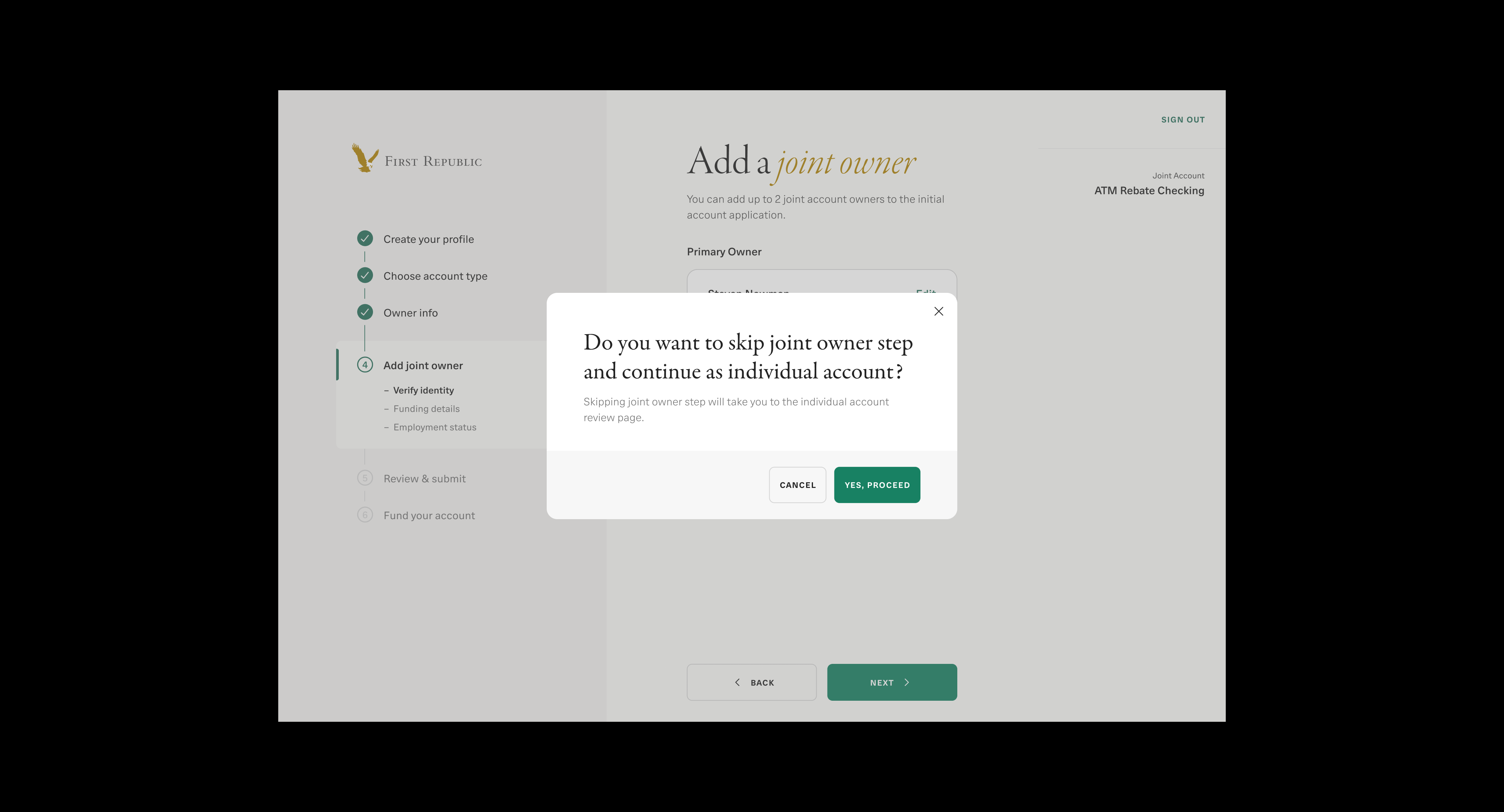

If the applicants select an individual account,

an additional step—"Add Joint Owner"—will appear in

the progress indicator, giving them the flexibility to add

1–2 joint owners later if they change their mind. If they

choose to skip the joint owner step, a pop-up will appear

to confirm their decision.

If the applicants select an individual account,

an additional step—"Add Joint Owner"—will appear in

the progress indicator, giving them the flexibility to add

1–2 joint owners later if they change their mind. If they

choose to skip the joint owner step, a pop-up will appear

to confirm their decision.

an additional step—"Add Joint Owner"—will appear in

the progress indicator, giving them the flexibility to add

1–2 joint owners later if they change their mind. If they

choose to skip the joint owner step, a pop-up will appear

to confirm their decision.

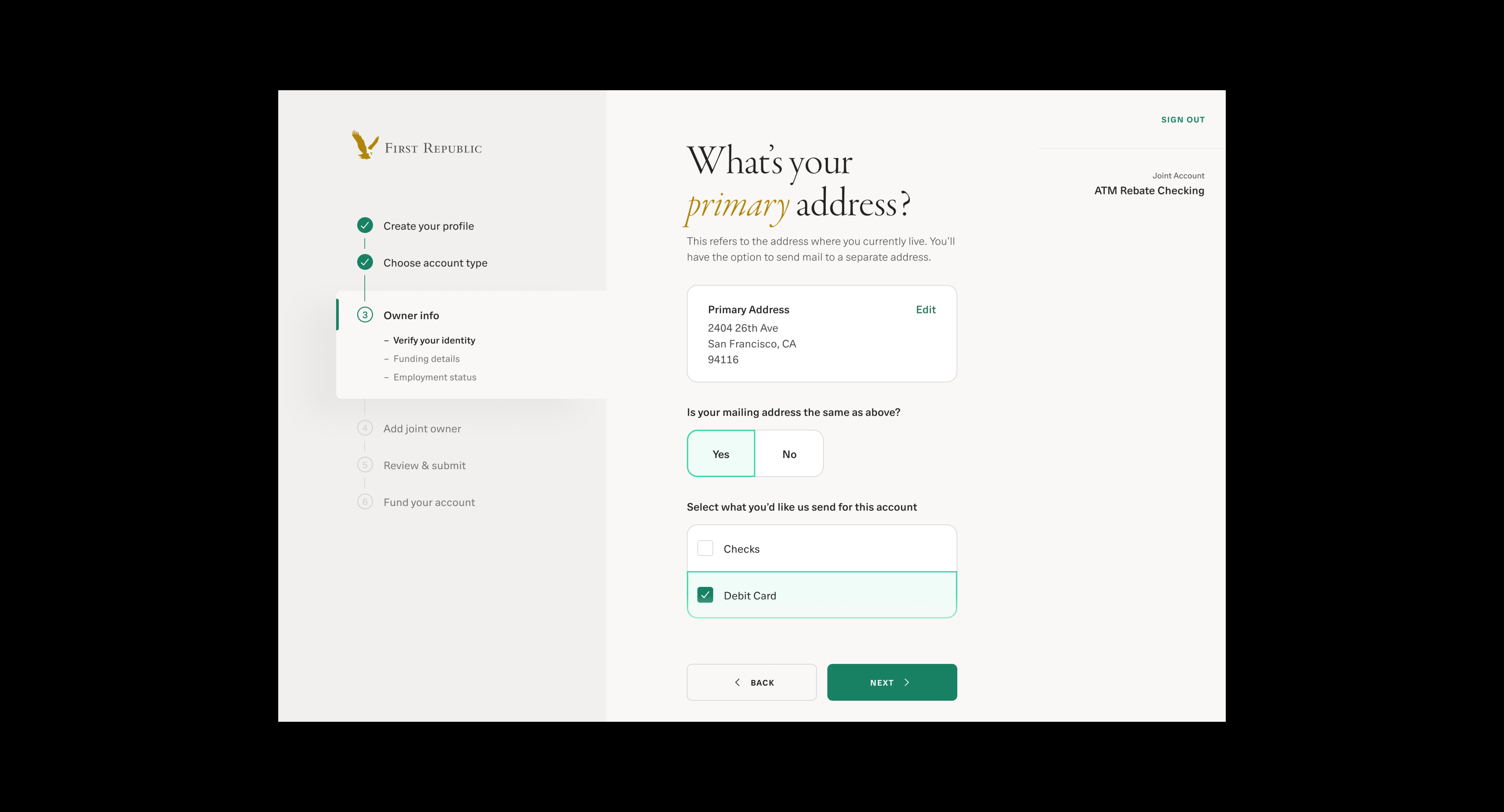

Address Validation

Before

After

Problem

Bankers have noted that digital account application

without validation, results in a higher rate of

input of

invalid addresses either for mailing or legal purposes.

They also have noted a reduced match strength on

address fields for risk-scoring external funding

transactions.

Goals

1. Ensure user inputs adhere to bank policy on

addresses for legal and mailing purposes.

2. Limit input of false or undeliverable addresses.

3. Reduce banker efforts to correct address errors.

4. Increase match probability within the funding

risk model.

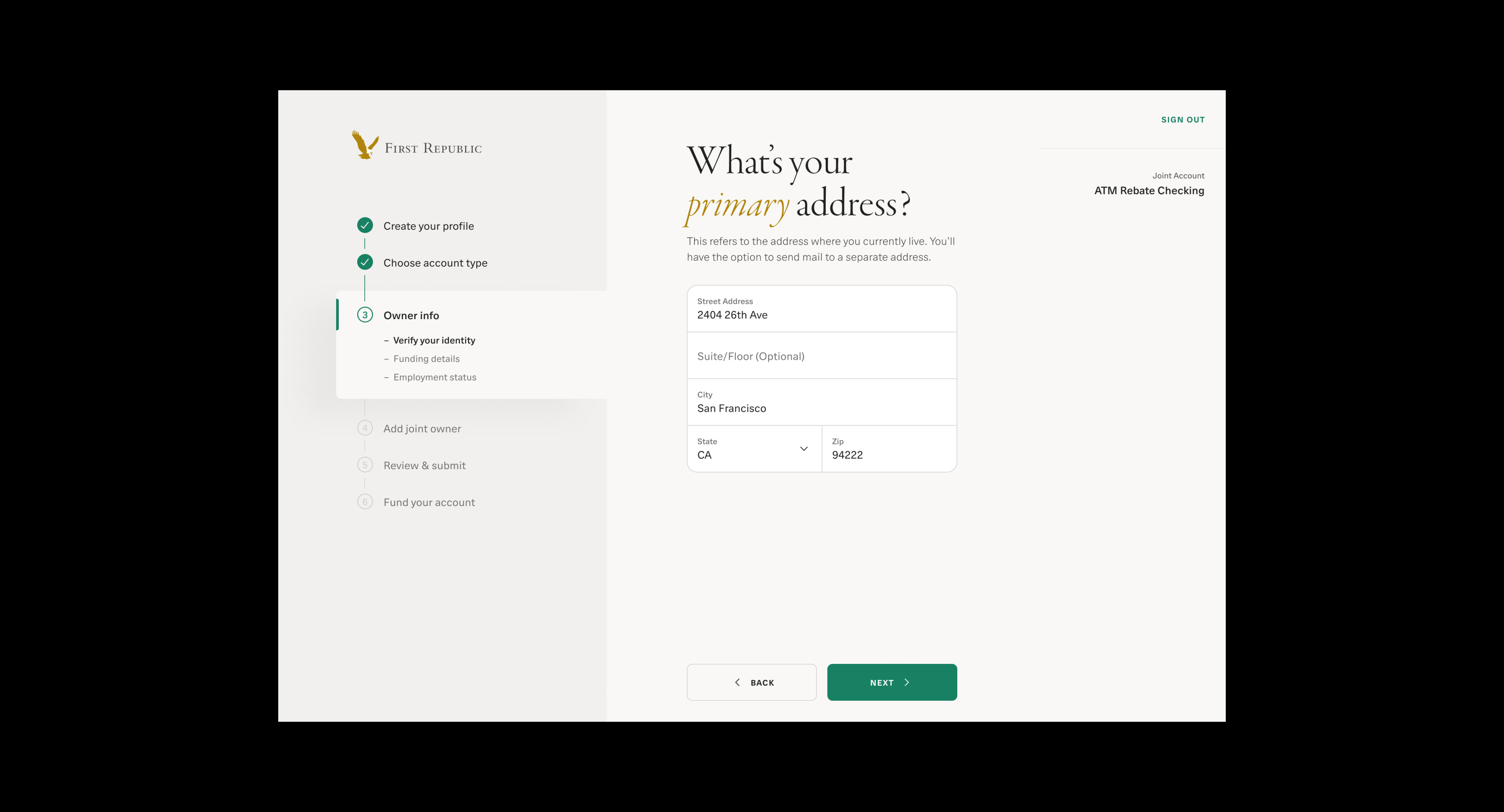

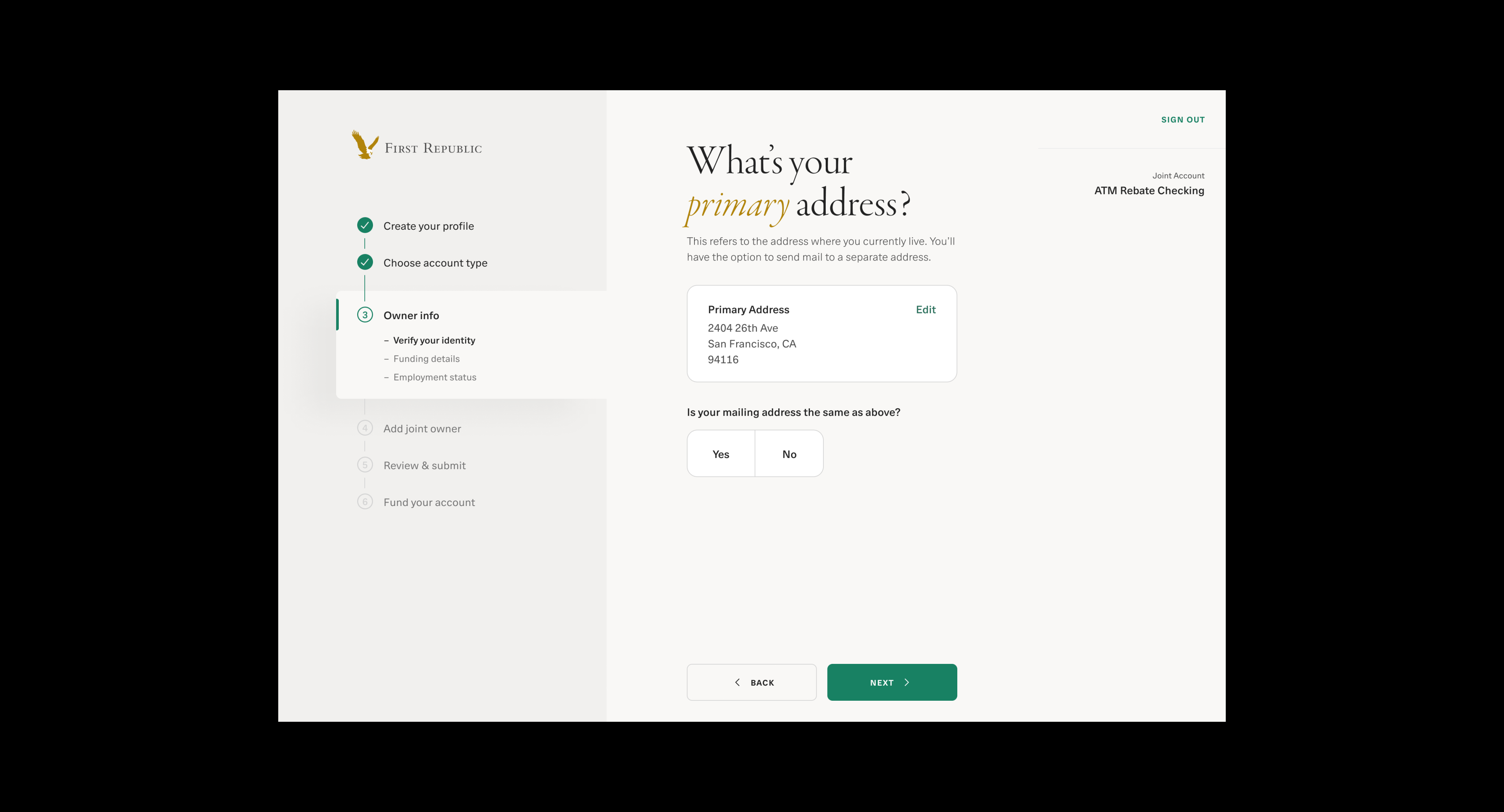

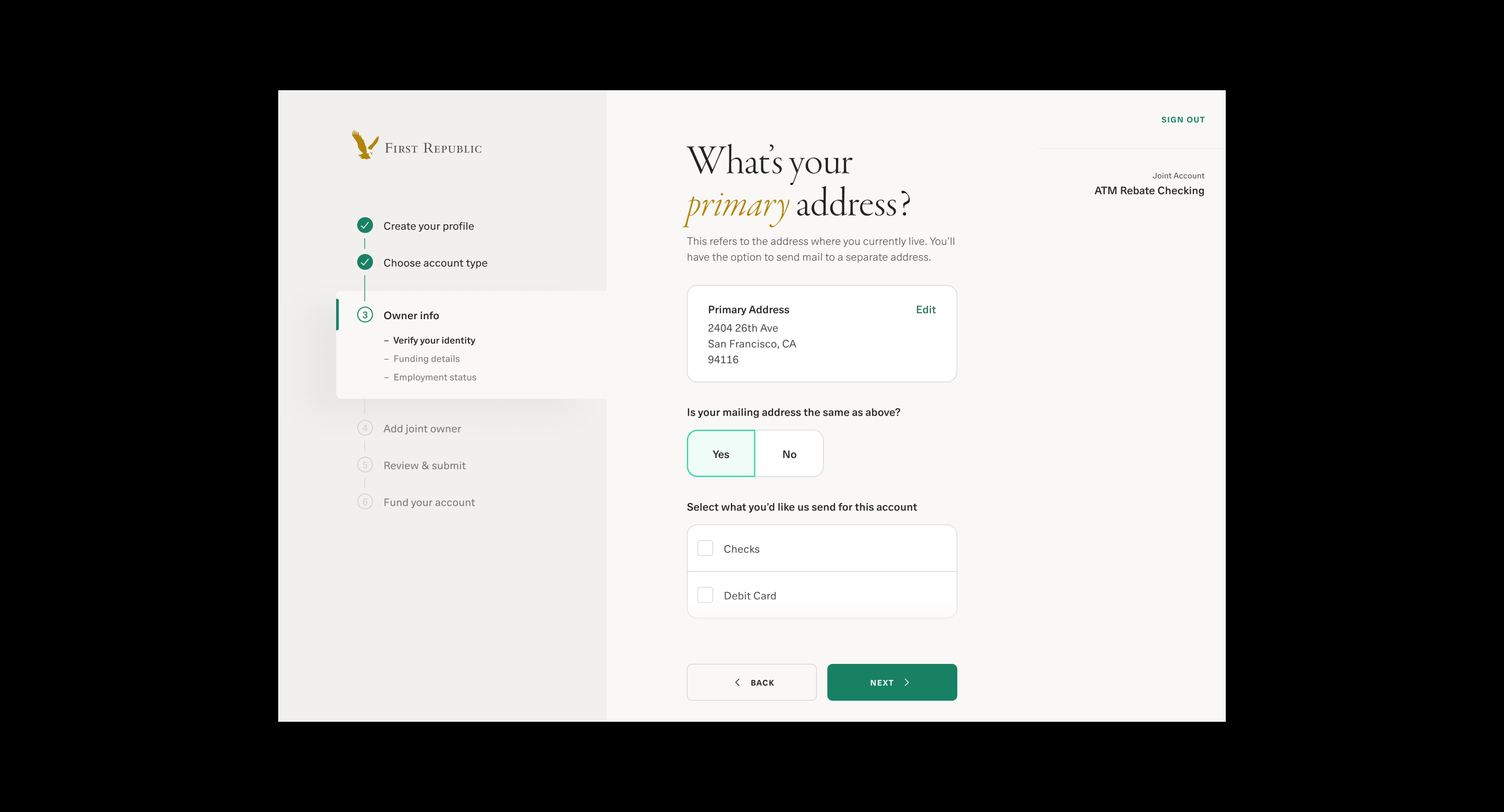

Solution

Implement address validation service to distinguish

different use cases for the primary address.

There are 5 different use cases below.

Use Cases

1. Happy path

When everything is correct user won’t see any pop-ups

showing up and

the user will get to the next

page right away.

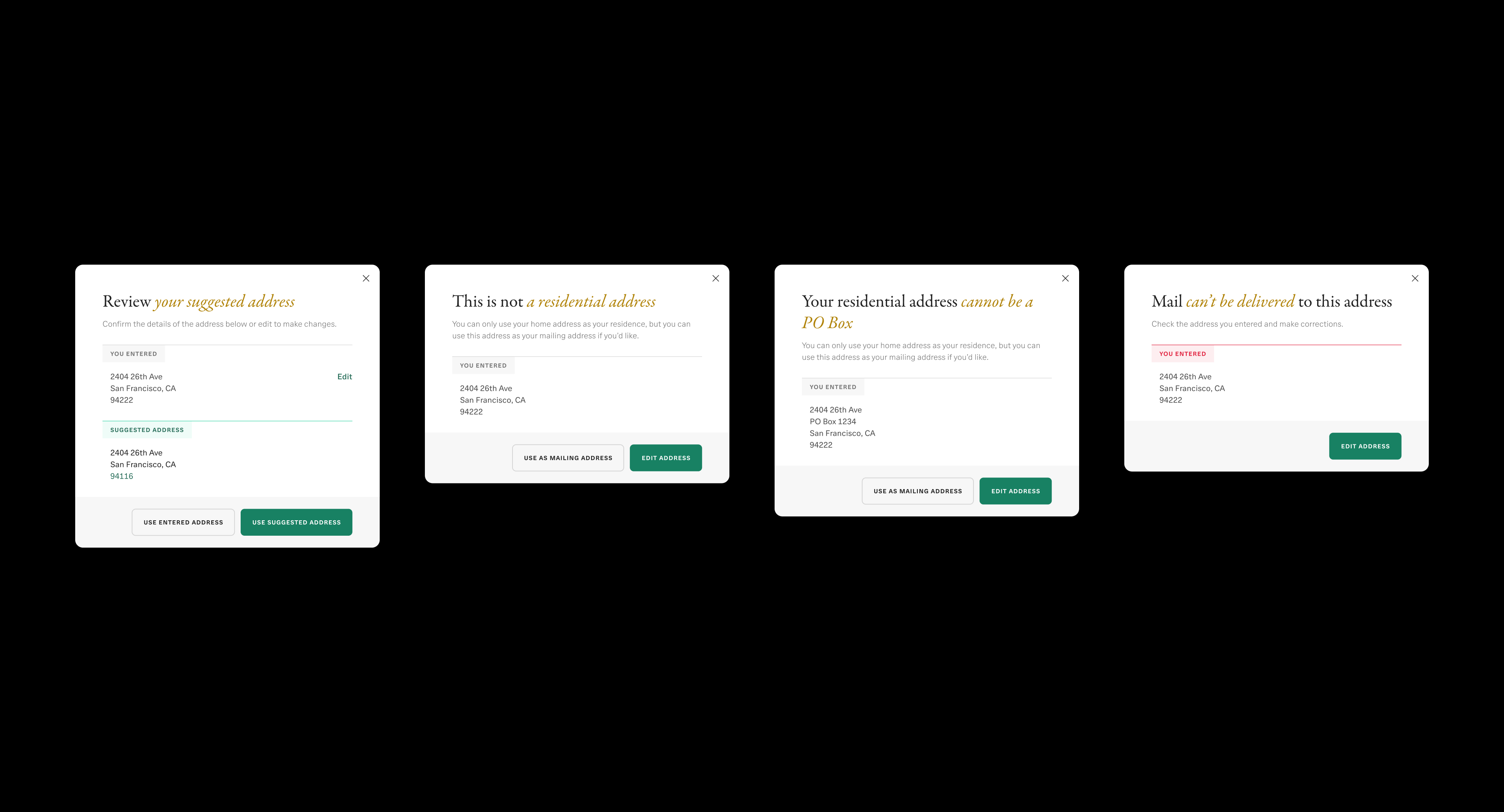

2. Suggested address

If the address provided by the user has a typo or wrong

zip code,

there will be a pop-up listing the entered

address and the suggested address

validated by USPS.

3. Non-residential address

If the entered address is a business address, there will

be a pop-up shows that “This is not a residential

address”. Only a home address can be used as

the

primary address, but applicants can use that as the

mailing address if they’d like.

4. PO box address

If the entered address is a PO box address, there will be

a pop-up shows that “Your residential address cannot

be a PO Box”. Only a home address can be used as

the

primary address, but applicants can use that as the

mailing address if they’d like.

5. Undeliverable address

If the entered address is unknown or deceased, there

will be a

pop-up shows that “Mail can’t be delivered to

this address”.

Reusable Components